The benefits of purchasing a vehicle from a dealership versus buying one privately.

Choosing where to buy a car is a major decision. In this essay, I will compare and contrast the advantages of buying a car from a dealership versus buying one privately.

Advantages of Purchasing from a Dealership

Wider Selection

Dealerships typically have a wider selection of new and used vehicles than private sellers. This means you have a better chance of finding the exact make and model you want. Plus, dealerships can leverage their network to locate a specific vehicle if it's not currently in stock.

Financing Options

Dealerships can offer a range of financing options, from loans to leasing, and can often offer more competitive rates than banks or credit unions. Additionally, some dealerships may offer special deals like zero percent interest or cash-back offers.

Wider Selection

Most dealerships offer warranties and maintenance plans that can help offset the cost of repairs for a set period of time. This can be especially helpful for new or certified pre-owned vehicles, and can provide peace of mind knowing you won't have to pay out-of-pocket for unexpected repairs.

Trade-ins

Dealerships can help you trade-in your current vehicle towards the purchase of a new one. This can simplify the process of getting rid of your old car and can potentially lower the overall cost of the new vehicle.

The advantages of buying privately.

Buying a car privately can be an attractive option for those who want a more flexible and customizable purchasing process.

1. Lower Prices

Private sellers typically price their cars lower than dealerships, as they don't have as many overhead costs or sales quotas to meet. Additionally, there may be room for negotiation on the price, which can result in even more savings.

2. Flexibility on Negotiations

When buying from a private seller, negotiations can be more flexible and personal. You may be able to negotiate directly with the seller and come to an arrangement that works for both parties, without having to go through a middleman.

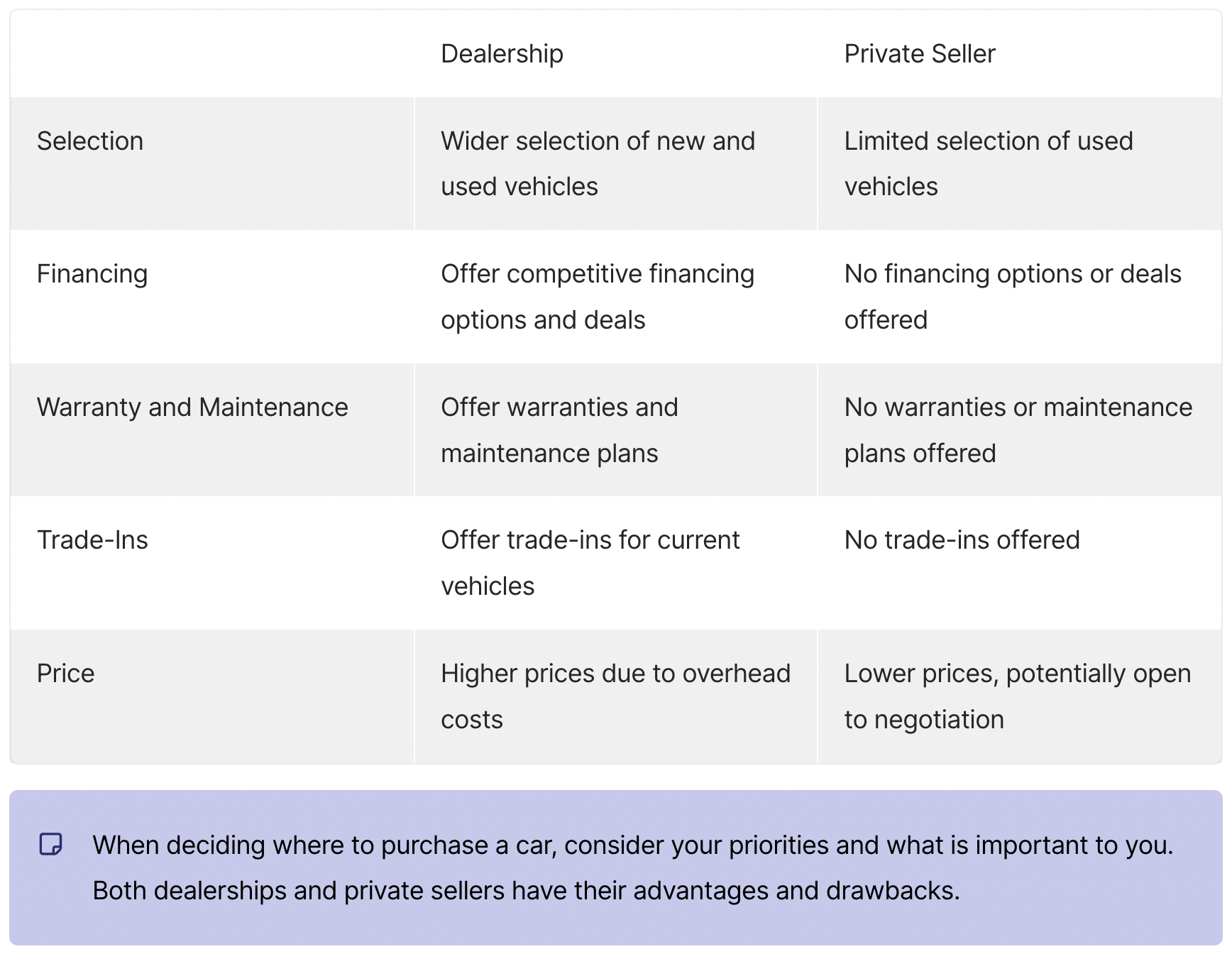

Now, let's compare and contrast.

Buying a car is a major investment, and the decision of where to purchase is an important one. There are benefits and drawbacks to both dealerships and private sellers. Consider your priorities and do your research to find the option that is best for you.

Other options for vehicle financing and refinancing:

Dealerhop: Connect with a fulfillment partner for financing, trading in, or selling your vehicle. Secure online financing for your upcoming car and have it conveniently delivered to your doorstep. Alternatively, you can schedule an in-store appointment.

Interest Rate: 6.99% - 29.99%

Loan Amount: $7,000 - No max

Loan Term: 12 - 96 months

Min. Credit Score: 300

Car Refinancing: Carrefinancing.ca offers the easiest way to refinance your car in Canada. Reduce your payments with decreased interest rates. Plus, you can postpone Payments for 6 Months and Receive Cash Back!

Interest Rate: 6.99% - 29.99%

Loan Amount: $500 - $100,000

Loan Term: 12 - 96 months

Min. Credit Score: 300